The Paul B Insurance PDFs

Wiki Article

Little Known Questions About Paul B Insurance.

House insurance coverage, also referred to as home owners' insurance, is not needed by the regulation. Most loan providers, however, set it as a problem for getting a mortgage. House owners' insurance coverage might function differently, depending upon numerous variables, including where your home lies, yet many supply the complying with coverages:

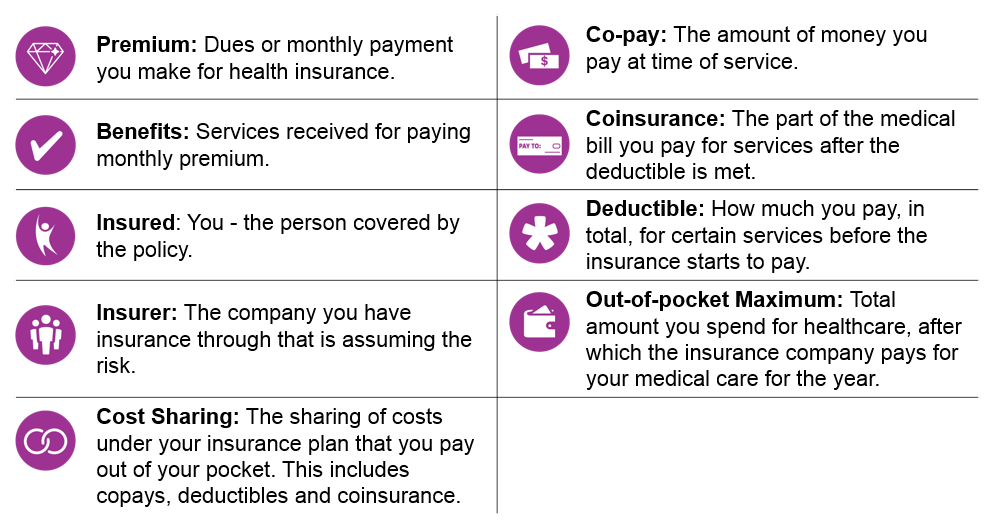

Insurance is an agreement, stood for by a plan, in which an insurance policy holder obtains economic protection or compensation versus losses from an insurance business. The firm pools customers' threats to pay more economical for the insured. Many people have some insurance policy: for their automobile, their residence, their medical care, or their life.

Several insurance plan kinds are available, and also virtually any individual or organization can discover an insurance firm happy to guarantee themfor a rate. Usual individual insurance plan kinds are auto, health, house owners, and also life insurance. A lot of individuals in the USA have at the very least among these kinds of insurance policy, as well as cars and truck insurance policy is called for by state regulation.

Thorough insurance coverage may or might not be the ideal kind of auto insurance coverage for you. 3 parts of any insurance coverage type are the costs, plan limitation, and also insurance deductible.

Paul B Insurance Things To Know Before You Buy

Several preventative solutions might be covered for totally free prior to these are satisfied. Medical insurance may be bought from an insurer, an insurance coverage agent, the federal Health Insurance policy Market, supplied by a company, or government Medicare as well as Medicaid insurance coverage. The federal government no longer needs Americans to have health and wellness insurance coverage, however in some states, such as The golden state, you may pay a tax obligation charge if you don't have insurance coverage.

Insurance is a means to manage your economic risks. When you acquire insurance coverage, you buy defense against unforeseen financial losses. The insurance provider pays you or somebody you choose if something negative occurs. If you have no insurance coverage and a crash takes place, you might be accountable for all related expenses.

Although there are several insurance coverage plan types, a few of one of the most common are life, health, house owners, as well as vehicle. The right sort of insurance for you will depend upon your objectives and also financial scenario.

Secret Inquiry 2 Among the things health and wellness treatment reform has actually carried out in the united state (under the Affordable Treatment Act) is to present more standardization to insurance coverage strategy benefits. Prior to such standardization, the benefits used varied considerably from strategy to plan. As an example, some strategies covered prescriptions, others did not.

Getting My Paul B Insurance To Work

Depending upon the plan you pick, automobile insurance can supply monetary security in the occasion your auto is harmed or swiped, you're wounded in a crash, or you're at fault for an accident that creates physical injury or residential or commercial property damage to third events. It can also help you satisfy any type of minimal insurance coverage needs mandated by your state or required by a lending institution.

On this page we'll cover several of the most usual sorts of cars and truck insurance coverage as well as offer some ideas for deciding just read the article how much insurance coverage you need as well as locating the most cost effective automobile insurance coverage available to you. Automobile insurance policy can work as a kind of building see this here and casualty (P&C) insurance coverage that gives economic defense if you remain in a vehicle accident, your vehicle is damaged in a non-collision occasion (e.

Some kind of cars and truck insurance is mandatory in many states, and also the legal demands and also minimal restrictions differ by state. Many need protection for third-party physical injury and residential or commercial property damage liability claims in the occasion you are at-fault in a crash and also wound one more motorist or their guests or trigger damage to somebody's residential property, such as a fencing or mailbox.

You can discover out just how much responsibility insurance coverage you need by visiting your state's Department of Electric motor Automobiles (DMV) or by visiting our Car Insurance Policy by State guide. Uninsured motorist (UM) coverage provides financial defense if you are hurt in an accident as well as the various other driver doesn't have cars and truck insurance policy.

site webThe Main Principles Of Paul B Insurance

Without insurance motorist coverage additionally pays if you are the sufferer of a hit-and-run. Your state may require you to lug a minimum quantity of uninsured motorist insurance coverage. You might also desire to take into consideration underinsured vehicle driver (UIM) protection, which usually pays the difference in between your expenditures and the plan restriction of the at-fault motorist when their limits want.

As always, talk to your state's DMV to identify if PIP is offered in your state as well as if you are called for to lug it. Like individual injury defense, clinical payments (Med, Pay) insurance coverage pays the clinical expenses for you and also your travelers for injuries suffered in a vehicle crash, no matter that is at mistake.

Medication, Pay is needed in some states and optional in others. It is not readily available in all states. Accident insurance coverage pays for repair services if your automobile is harmed during an automobile accident or if it collides with an additional things like a building or tree, even if you're at mistake. It might additionally cover damage from potholes.

Most states call for chauffeurs to bring responsibility insurance, however some call for added sorts of coverage, like uninsured driver insurance coverage or individual injury protection (PIP). If you fund or lease your automobile, it's additionally best to get in touch with the loan provider or lessor to identify what type and amount of protection is needed as part of your financing or lease arrangement.

The smart Trick of Paul B Insurance That Nobody is Discussing

This needs special insurance policy protection, however thankfully there is a whole sector that accommodates such cars. Vintage car insurance policy is an expanding industry, with Hagerty as one of its most remarkable names. American Collectors Insurance Coverage, Grundy, and a lot of the significant insurers offer vintage car insurance. Common automobile insurance normally covers insurance holders for the actual cash money value of their vehicles, suggesting that an automobile will certainly be assessed for its age, condition, as well as depreciation contrasted to comparable vehicles.

Submitting a vehicle insurance coverage claim can be overwhelming, and also each insurance coverage business has their very own process as well as tools in place. There are some points you can do to make the process much easier. Right away call your auto insurance policy representative. Explain what occurred, and also discover what your policy covers in addition to any kind of deadlines for submitting a case.

Depending upon the nature of your insurance claim, you may need to consist of an authorities report, pictures of the damage, the names and also details of any person associated with the mishap, as well as a repair work quote. Your insurance firm ought to be able to provide you with a list of info or papers you need to include.

You can generally send an official claim over the phone or by means of your insurance coverage business's website or mobile app. Here are three reasons that insurance companies might reject insurance claims: The motorist is somebody who lives with you or has accessibility to your cars and truck and also is of driving age however not on your policy.

Report this wiki page